RSA Solutions Limited is a boutique software solutions provider in bangladesh

T +88 02 9851971-4

Email: solutions@rsasolutions.net

RSA Solutions Limited

06 Gulshan Avenue, Level-3 Block-SW(H),Gulshan-1

Why use IDP ?

- Digitize customer onboarding

- Implement straight thru processing

- Eliminate manual data entry

- Automate scorecard creation

- Save time and cost

- Days of manual keying reduced to minutes

- Increased customer convenience

- Faster time -to-approval for more sales

- Overall improvement in of customer onboarding

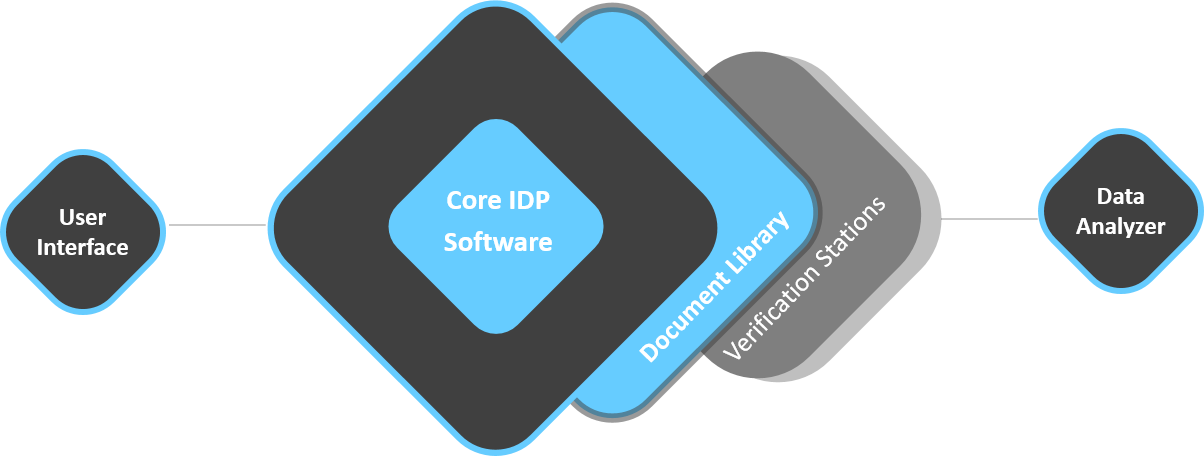

How does it work ?

Assisted Customer onboarding & Self check-in covering

- Data Capture and generation

- Identity verification(NID) extracting the key e-KYC information in English and Bangla for authentication against the Election Commission database

- IDP’s facial recognition and fingerprint matching features provides for the biometric authentication in a multichannel environment

- Sanction and other screening

- Account opening

- Customer profiling

- Customer risk grading

Standard, Enhanced and Configurable Customer Due Diligence (CDD & EDD) covering

- UNSHC Sanction, PEP/IP & other Internal/External screenings

- Audit trail of customer profile

- Configurable matching parameter rules

- Security measures

Benefits

- AMP’s e-KYC solution integrates seamlessly into the CAIROS™ product suite, including the Intelligent Document Processing (IDP) and Loan Origination System (LOS) solutions, providing comprehensive compliance with the BFIU requirements

- e-KYC “can save time of onboarding from 4-5 days to 5-6 minutes”, reducing cost of customer onboarding and KYC “by 5-10 times”, and “growth of business … around 25%”.

Features

- End to end origination

- CRM

- Campaign management

- Loan dashboard

- Application digitization

- Automated document analysis

- Document management

- Integrate third party data

- Automated scorecard generation

- Workflow

- Approval management

- Automated document assembly

- Datamart and business intelligence

- Risk management

- Reports

- Rules engine

- Rewards/Commission system

Features

- Automated Repayment Processing

- Support for new loan type

- Automated reconciliation

- Customized risk alert

- Customer statement and mangement reporting

- Flexibility to handle any interest methodology

- Full set of customer service funtion

More Features

- Easy loan set up

- Fee management

- Loan renewals/ top-ups

- Early repayments

- Ad hoc payments

- Debit changes

- Restructuring

- Payment holidays

- Collections & write offs

Supports Multiple Loan Options

- Flat or declining balance interest

- Daily/banking day/weekly/monthly repayments

- VAT

- Origination fees

- Taxes and duties

- Late payment fees

- Early payment fees

- Loan restructures and holidays

K Mahmood Sattar

Chairman

Kazi Mahmood Sattar has over 38 years of banking experience, mostly with international banks. He started his career with ANZ Grindlays Bank as a Management Trainee in 1981. In his overseas stint, he spent one year in Mumbai as a Corporate Dealer with Treasury. He also worked more than two years in Melbourne, Australia as Manager Corporate Banking. Mr. Sattar underwent extensive training in investment banking and successfully established Bangladesh’s first Investment Banking Arm/Corporate Finance Unit. He took over as Head of Corporate and Investment Banking Division of ANZ Grindlays Bank in Bangladesh in 1995.

Mr. Sattar led two large domestic commercial banks as Managing Director and Chief Executive Officer. While heading two large old-fashioned banks, he successfully modernized them by reorganization, modernization, implementation of state of art IT system and converted the culture and business to compete with the international banks in the country.

Mr. Sattar is currently the Chairman of RSA Advisory Limited. He is also an Independent Director of BRAC Bank Limited and Unique Hotel & Resorts Limited. He is also a member of the Board of Directors of bKash Limited.

Thomas J DeLuca

Chief Executive Officer, AMP Credit Technologies

Thomas J. DeLuca is CEO of AMP Credit Technologies, a Hong Kong-based financial technology company which provides an outsourced processing platform for banks and other institutional lenders to lend to small businesses based upon their cash flow, on a profitable and scalable basis. AMP’s proven proprietary loan management system leverages concepts and principles from microfinance, payment processing, social media, and ‘big data’—together with more traditional loan underwriting principles—to help banks lend to their small business customers on a profitable and efficient basis.

Prior to founding Advanced Merchant Payments, he was a co-founder of Planet Payment, Inc., a multi-currency payment processor publicly-traded on the NASDAQ Stock Market, and dedicated to enabling internationally-focused processors, acquiring banks, and merchants to accept, process and reconcile credit card transactions in multiple currencies. He started his payment career in the legal department of American Express, where he provided legal and strategic advice to the merchant services division regarding electronic commerce matters, consumer privacy, marketing, and general commercial issues pertaining to credit card transactions.

He received his B.A. Degree, M.B.A., and Juris Doctor (J.D.) from St. Johns University and his Master of Laws (LL.M.) in International Trade and Business Transactions from Fordham University in New York.

Md. Arefur Rahman

Managing Director, RSA Solutions Limited

Md. Arefur Rahman has over 14 years of experience in design and developing softwares and business applications that facilitate better management of data, automate processes and allow organisations to meet their business objectives. Formerly he was Head of IT of Apex Investments Limited, a leading brokerage house and has contributed to significant IT infrastructure growth acceleration. While at Apex, Arefur had created the first mobile app for trading in Dhaka Stock Exchange in Bangladesh.

Arefur possesses significant knowledge on IT applications of Sales, Distribution, Inventory, Manufacturing, Production, HR, Payroll, Capital Market and Financial software development. He has also significant knowledge on software development methodologies and has considerable experience in client relationship management and business development.

Arefur attended different training and workshop captioned on IT, Project Management Professional, Oracle Certified Professional, Capital Market of Bangladesh, Microsoft Professional Training etc. He completed his MBA from East West University and BSc. in Computer Science and Engineering from The University of Asia Pacific.

Contact details

RSA Solutions Limited

06 Gulshan Avenue, Level-3

Block-SW(H),Gulshan-1

Email: solutions@rsasolutions.net

Phone: +88 02 9851971-4